Dominium:the full review ico

Overview

A new ITO (Initial Token Offering) is on the block that is leveraging the lucrative $217 trillion real estate market that is riddled with outdated technology, complicated regulations, and middlemen like financial institutions and agents. This ITO is Dominimum platform, which is planning to remove the barriers of middlemen, lack of transparency and language by integrating the real estate sector with blockchain technology.

Dominium

“Decentralized, Regulated, Property Financing, Property Listing and Property Management Platform”

Dominium is basically the idea of a group of real estate professionals who are committing their capital, expertise, and property to this platform.

In more simpler words as defined by the team,

“Dominium is a complete platform for “all things property related”. You can perform a lot of different actions, such as, rent a house, set up a property fund or message your builder. Everything that happens on the platform is registered on the blockchain, which means that there is a public record of it.”

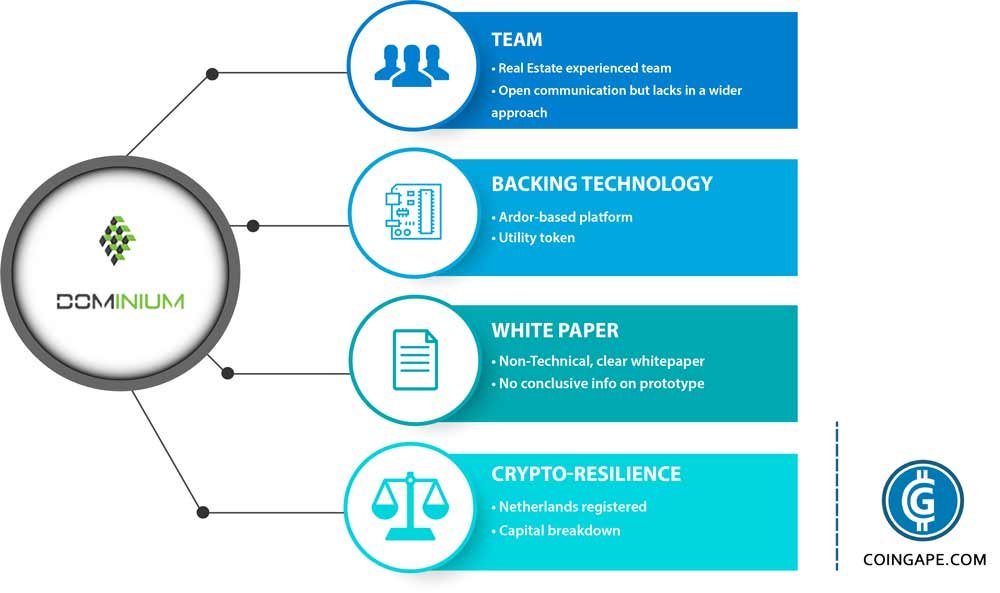

What have we Got? A non-technical whitepaper

The whitepaper of the project is pretty clear and to the point presenting all the facts and figures along with the company details. However, it lacks technical aspects regarding the blockchain.

When it comes to the prototype, the team doesn’t have any open source codes. Though there have been many projects out there that have been launched without a prototype, it affects the credibility of the project from an investor point of view.

The funds so collected in the pre-ITO and ITO round will be used to purchase the leveraged property portfolios in Netherlands, UK, and Germany. Though there are no clear stats of how the funds will be used, it has mentioned that the income generated from the property purchased will be used to develop, support, and maintain the platform.

Team profile

The team of this project primarily comprises of Directors and Ambassadors. They have about 4 directors including finance and property directors who have years of experience in the real estate sector.

Sven-Thomas Munte — Chairman, Sven is a veteran in the real estate sector having owned and managed the property management company that manages about 70 homeowner communities and over 3000 rental apartments.

Mark Lloyd — Managing Director, Mark is all about the property as he is the property investor, coach, mentor, and speaker.

They have about 10 ambassadors from all over the world including the Netherlands, Japan, Spain, Russia & Ukraine, Vietnam, India, France, Nigeria, Korea, Indonesia, and Turkey.

The team has rich experience in the real estate sector which is good but lacks talent in other departments as there is no mention of other team members.

The business model, DOM: An asset token

The native token of Dominium platform is DOM, a utility token that is “used on the Dominium platform for services/use of the platform features”. This token can be used for a multitude of activities such as creation and trading of assets, voting for charities, listing a property for sale or rent and registering a rental or purchase agreement. Moreover, all the fees charged on the platform will be in EURO, but can only be paid in DOM tokens.

In order to tackle the fluctuations in the crypto market or platform performance for that matter, Dominium is employing the buyback program. According to the team, this will stabilize the DOM token like USDT or gold backed tokens.

“All DOM transaction fees used on the platform will be taken out of circulation and burned (i.e. destroyed)” ensures the company.

Through token burn and buyback program, it will be ensured that the tokens have a diminishing supply. Token burns will be audited and announced publicly.

Backing technology: Ardor-based Blockchain

Dominimum platform is built on Ardon childchain which basically allows one to utilize the advanced features of Nxt blockchain technology. They are also planning to obtain a regulatory license so that the creation of legal templates for property funding can be standardized.

The question here is why Ardor blockchain. To get a better clarification we asked Dominimum team that explained,

“Ardor technology has managed to overcome the problem of blockchain bloat that makes translations slow and expensive. Ardor also has the added feature of controlled assets, voting system and other features which make the development of Dominium easier. Ardor’s permissioned childchain allows us to implement different security clearance levels and open up different features on the platform accordingly. This is important to our AML/KYC and compliance adherence.”

Well, that makes sense!

Crypto-sale resiliency

The company behind Dominium platform is Dominium B.V. which is Netherlands registered company that has been incorporated in March 2016.

The company might not have a diverse team but it has tried to overcome that weakness by appointing 8 advisors from different fields. From blockchain, legal to compliance, and marketing, Dominimum has quite a bunch of experienced and diverse advisors.

Token distribution

The total supply of DOM tokens is 1 billion. Out of this 100 million are for the seed round and another 100 million for pre-ITO at €0.05 per DOM. 500 million DOM tokens are for ITO round at various prices. Airdrop and referral program is allocated 50 million DOM tokens each. The remaining 200 million tokens will go to the founders and team of the Dominimum.

Community acceptance

Dominium has created its presence on a wide range of social media platforms. From Facebook, Twitter, Telegram, Youtube to Medium, Instagram and LinkedIn, they have taken a broad approach. It has over 5k followers on Twitter and about 1240 members on Telegram.

However, the project is not available on Reddit and GitHub which is essential for the blockchain community to share their open source codes.

Roadmap

Stage of Project:

Dominium is currently at its ITO stage in quarter 3 i.e. September having completed its regulatory compliance in UK, Germany, and Dutch. As per its roadmap, the company is at the right pace, however, the further milestones regarding migrating the assets to the platform and acquiring regulatory documents don’t have a specific date or quarter, rather will get completed by the end of next year.

Major Hurdle:

According to the team,

“Sometimes it is hard to grasp the enormity of this project. Dominium is perhaps ahead of its time, as it has the potentially to become a land registry for the entire world, with all the information about all property recorded on the blockchain, for all to see”.

The goal is progressive no doubt, but given the limelight, ICOs are receiving from the authorities, it is yet to be seen if the project will be able to tackle the complications of regulations this vision will have to go through.

A note to investors

The idea to connect the lucrative real estate market with the growing blockchain market is a progressive step. With an aim to target the regulatory documentation compulsions, language barrier, and middlemen, Dominimum makes a strong point. Also, there is already a company in existence behind the project that adds to its value. However, apparently it does have a prototype but the website doesn’t provide any info on that. Moreover, the company might have appointed advisors from varied fields including blockchain, the core team members haven’t been listed apart from directors. Overall, it’s a pretty straightforward project that combines two popular and lucrative industries, aiming to simplify real estate finance, management, and trade.

Methodology

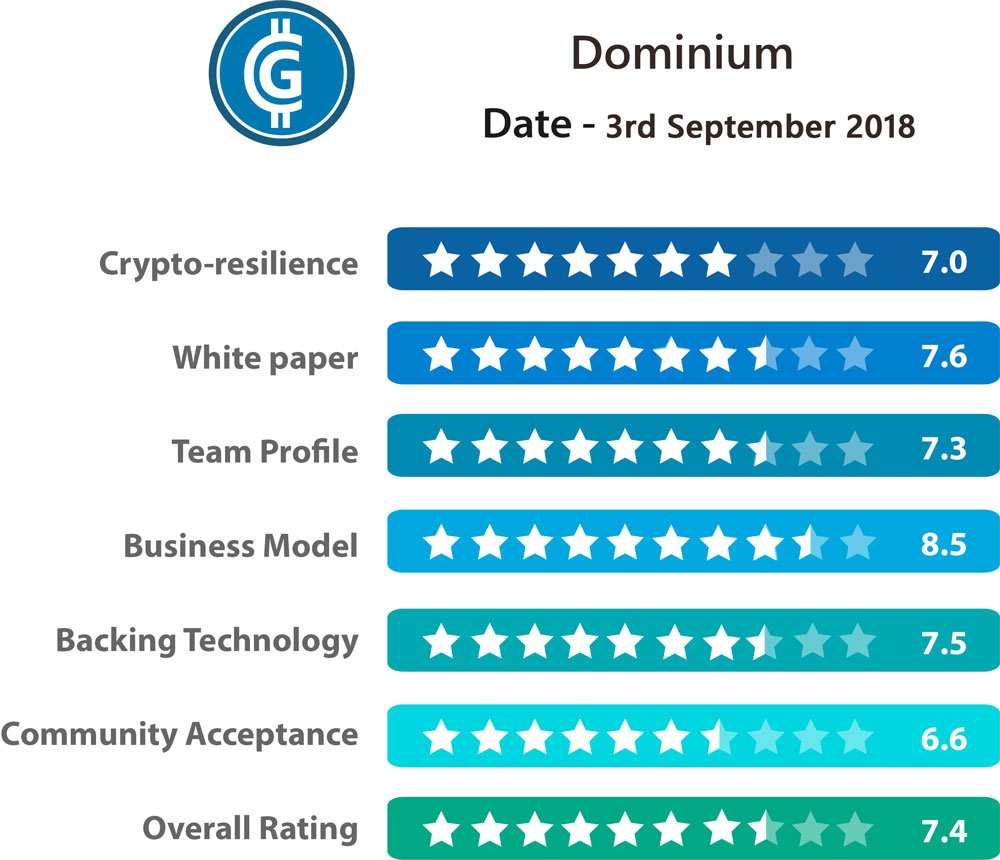

To rate an ICO, we follow a list of parameters that are basically the KPIs (Key Performance Indicators) of a project viz:

Whitepaper — Availability of code or prototype, the breakdown of funds, wallet for crowdsale

Team Profile — Team’s strength and reputation

Business Model — Problem solved, purpose & utility of the token and the economic model

Backing Technology — Blockchain infrastructure, clarity of terms & conditions and token software

Crypto-sale Resilience — Incorporation, token distribution, legal risks and security aspect

Community Acceptance — Clarity & frequency of communication and social media presence

Team Profile — Team’s strength and reputation

Business Model — Problem solved, purpose & utility of the token and the economic model

Backing Technology — Blockchain infrastructure, clarity of terms & conditions and token software

Crypto-sale Resilience — Incorporation, token distribution, legal risks and security aspect

Community Acceptance — Clarity & frequency of communication and social media presence

By asking the right questions, we maintain the integrity and viability of our ICO reviewwhile following a rating method that is based on the criticality of a particular factor. For instance, elements like token utility and funds breakdown have been given the highest importance while the team members’ reputation and plan to attract a user base are of medium criticality.

We have a team of robust professionals who rate the ICO projects in a completely unbiased manner.

Want your ICO to be reviewed by Coingape? Let us know

Caution: Coingape publishes the ICO project reviews only for the information purpose. It is not an invitation for investment. When making investment decisions, conduct your individual assessment and consult with an advisor.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Do not forget to follow our media handles and stay updated:

My Bitcointalk Profile:https://bitcointalk.org/index.php?action=profile;u=1903236

Comments

Post a Comment