THE FULL REVIEW ON GABROTECH DECENTRALIZATION AND BLOCKCHAIN TECHNOLOGY ICO

Hello everybody on this occasion I will review the Gabrotech project. If you are interested in joining the Gabrotech project, it's good to read reviews that can help you get information that might help you see their vision and mission, as your reference please visit the official website we:

WEBSITE: https://gabrotech.io/

WHITEPAPER: https://cdn.shopify.com/s/files/1/0067/8313/9898/files/Whitepaper_LongVersion_Portrait_v17.pdf

FACEBOOK: https://m.facebook.com / gabroTech6 /

TWITTER: https://twitter.com/gabrotech

TELEGRAM: https://t.me/Gabrotech

WHITEPAPER: https://cdn.shopify.com/s/files/1/0067/8313/9898/files/Whitepaper_LongVersion_Portrait_v17.pdf

FACEBOOK: https://m.facebook.com / gabroTech6 /

TWITTER: https://twitter.com/gabrotech

TELEGRAM: https://t.me/Gabrotech

About Gabrotech

GABROTECH is a new decentralization project that will allow customers from many large stores to depend on their bonuses. In this case, the GABROTECH project user will be able to get a physical card to apply the bonus at the right time, or redeem it with offers from other organizations in this segment.

GABROTECH project features

.png)

GABRO PREMIUM CARDS

To receive Gabro Premium cards, users must hold 25,000 GBO in their Gabro digital wallet. Limited supplies.

To receive Gabro Premium cards, users must hold 25,000 GBO in their Gabro digital wallet. Limited supplies.

Alliance Premium card holders will also receive GBO 0.5% in return, which can be exchanged or converted to currency or other air miles. Travel and travel insurance will be offered up to USD 100,000.

GABRO STANDARD CARD

To receive a Gabro Standard card, users must hold 10,000 GBO in their Gabro digital wallet. Limited supplies.

To receive a Gabro Standard card, users must hold 10,000 GBO in their Gabro digital wallet. Limited supplies.

Standard Standby card holders will also receive a 0.1% reward for GBO in return, which can be exchanged or converted to currency or other air miles. Travel and travel insurance will be offered up to USD 100,000.

.png)

GABRO DIGITAL WALLET

This gives you the convenience of managing different loyalty programs and reward points. Built into Gabro Digital Wallet is an advanced security feature to help protect transactions in a number of ways: biometrics, face recognition, access code access, and pattern recognition.

This gives you the convenience of managing different loyalty programs and reward points. Built into Gabro Digital Wallet is an advanced security feature to help protect transactions in a number of ways: biometrics, face recognition, access code access, and pattern recognition.

GABRO TOKEN UTILITY

GBO will be the core of merchant reward ecosystem. Gabro is needed to get access to services in the Gabro ecosystem. For traders, this serves as a payment mechanism. For users, this serves as a way to unlock special discounts and to redeem prize points or Merchant Tokens. They serve different roles for both parties and therefore offer different benefits for them.

GBO will be the core of merchant reward ecosystem. Gabro is needed to get access to services in the Gabro ecosystem. For traders, this serves as a payment mechanism. For users, this serves as a way to unlock special discounts and to redeem prize points or Merchant Tokens. They serve different roles for both parties and therefore offer different benefits for them.

GABRO WARRANTY CARDS

Refill with your reserve prize points to spend on assets in more than 200 countries with 60 million outlets. Gabro aims to achieve this through partnerships with leading global payment service providers, which will be announced in the future.

Refill with your reserve prize points to spend on assets in more than 200 countries with 60 million outlets. Gabro aims to achieve this through partnerships with leading global payment service providers, which will be announced in the future.

.png)

MULTI-CURRENT CONVERSION MACHINE

MCCE is a protocol system that utilizes our liquidity pool. Our platform quickly converts blockchain assets that are backed up to fiat currencies that match real-time market value.

MCCE is a protocol system that utilizes our liquidity pool. Our platform quickly converts blockchain assets that are backed up to fiat currencies that match real-time market value.

ANALYSIS OF O2O PLATFORM

For traders, O2O Gabro's analytical platform provides insight into customer trends and preferences, while the execution platform provides personalized digital channels to issue branded merchant tokens. Relevant offers can be targeted through platforms based on previous transactions with Gabro and traders.

For traders, O2O Gabro's analytical platform provides insight into customer trends and preferences, while the execution platform provides personalized digital channels to issue branded merchant tokens. Relevant offers can be targeted through platforms based on previous transactions with Gabro and traders.

CENTRAL LOYALTY

This is a loyalty gift platform that allows users to change inactive points from a single brand or program to add another. In addition to exchanging prizes, consumers can exchange Gabro for prize points with other traders.

This is a loyalty gift platform that allows users to change inactive points from a single brand or program to add another. In addition to exchanging prizes, consumers can exchange Gabro for prize points with other traders.

TOKEN SALES PROCESS

June 1, 2018: Launch of the prototype and Gabro Wallet 2.0 pre-order list.

July 31, 2018: Starting date for selling GBO Tokens.

30 August 2018: Additional partnerships with exchanges and currencies.

August 31, 2018: End date of GBO Token sale.

1 Sep 2018: Launch of the loyalty campaign and live broadcast.

October 1, 2018: Launch other merchant coins on our platform.

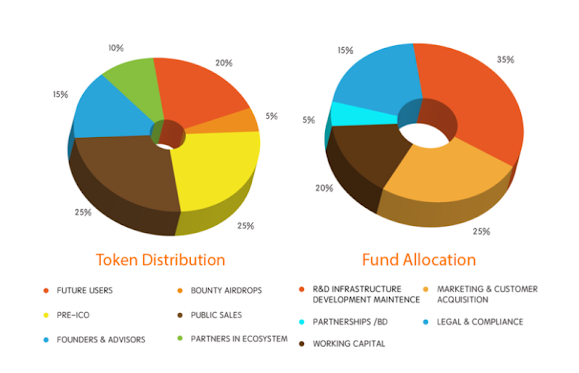

TOKEN DISTRIBUTION SEQUENCE

July 31, 2018: Starting date for selling GBO Tokens.

30 August 2018: Additional partnerships with exchanges and currencies.

August 31, 2018: End date of GBO Token sale.

1 Sep 2018: Launch of the loyalty campaign and live broadcast.

October 1, 2018: Launch other merchant coins on our platform.

TOKEN DISTRIBUTION SEQUENCE

Symbol Token:

Supply Token Total GBO: 1,000,000,000 GBO

Hard Cap: $ 50M

Selling price: 1 ETH buy 5000 GBO

Minimum purchase: 0,1 ETH

Receive: Ethereum (ETH)

ERC20 Token: Yes

Individual Stamp: No

Escrow Fund: Funds are guaranteed in a State-permitted Multi-signature escrow account

: As specified in the Gabro tech PTE single policy

Supply Token Total GBO: 1,000,000,000 GBO

Hard Cap: $ 50M

Selling price: 1 ETH buy 5000 GBO

Minimum purchase: 0,1 ETH

Receive: Ethereum (ETH)

ERC20 Token: Yes

Individual Stamp: No

Escrow Fund: Funds are guaranteed in a State-permitted Multi-signature escrow account

: As specified in the Gabro tech PTE single policy

Bonus structure

5 ETH or more = 10% bonus GBO

10 ETH or more = 15% bonus GBO

30 ETH or more = 20% bonus GBO

Bulk purchase offers and other early birds are also available.

10 ETH or more = 15% bonus GBO

30 ETH or more = 20% bonus GBO

Bulk purchase offers and other early birds are also available.

MILESTONE COMPANY

September 2017: Gabrotech was founded.

Jan 2018: Prototype Built.

February 2018: Agreement signed with a prepaid card issuing company.

Mar 2018: White book intact.

Apr 2018: Key executive on board.

May 2018: Official Website Launch.

Jun 2018: Roadshows in several countries.

July 2018: Launch of Token Sales.

August 2018: Live pre-registration application.

October 2018: Register for loyalty merchant partners.

December 2018: Gabro loyalty rewards platform release.

Jan 2019: Launch of a multi currency conversion machine (MCCE).

February 2019: Gabro Card sent in Asia.

Mar 2019: O2O analytics and release execution platform.

Apr 2019: Gabbro Card to be sent to Europe.

Jan 2018: Prototype Built.

February 2018: Agreement signed with a prepaid card issuing company.

Mar 2018: White book intact.

Apr 2018: Key executive on board.

May 2018: Official Website Launch.

Jun 2018: Roadshows in several countries.

July 2018: Launch of Token Sales.

August 2018: Live pre-registration application.

October 2018: Register for loyalty merchant partners.

December 2018: Gabro loyalty rewards platform release.

Jan 2019: Launch of a multi currency conversion machine (MCCE).

February 2019: Gabro Card sent in Asia.

Mar 2019: O2O analytics and release execution platform.

Apr 2019: Gabbro Card to be sent to Europe.

GABRO TEAM

GABRO FOUND BY TEAM FROM 6 BLOCKCHAIN ENTHUSIASTS. THE TEAM HAS ACCUMULATED OVER 100 YEARS OF EXPERIENCE IN PAYMENTS IN DIFFERENT BANKS, CARD REPLACEMENT NETWORKS, AND FINTECH COMPANIES. GABRO TEAM BASED IN CHINA, HONG KONG, SINGAPORE, AND UK.

CHAIRMAN - ANDY, PK CHEN

Andy, PK Chen has worked at Capital One in the US, Accenture in the UK, BCGand Credit Suisse in Asia Pacific. His last position is GM, Head of China, Mastercard Advisors. Over the past 20 years, he has advised many companies on digital strategy and transformation, as well as smaller business ventures on how to disrupt the market with much larger old players. He also sits in various Fintech Associations as a Member of Exco and has advised government agencies to promote Blockchain and Fintech. He has a Masters degree from Imperial College and has completed a Quantitative Finance program at Stanford University.

Andy, PK Chen has worked at Capital One in the US, Accenture in the UK, BCGand Credit Suisse in Asia Pacific. His last position is GM, Head of China, Mastercard Advisors. Over the past 20 years, he has advised many companies on digital strategy and transformation, as well as smaller business ventures on how to disrupt the market with much larger old players. He also sits in various Fintech Associations as a Member of Exco and has advised government agencies to promote Blockchain and Fintech. He has a Masters degree from Imperial College and has completed a Quantitative Finance program at Stanford University.

CHIEF MARKETING OFFICER - KIM, KW MAK

Kim, KW Mak has 20 years of digital marketing experience and credit cards. He recently partnered with one of the largest digital asset platforms to promote ICO and token trading. Prior to that, he worked as Head of Business Development and Head of Account Management at a digital marketing company registered on Nasdaq. He started his career at American Express.

Kim, KW Mak has 20 years of digital marketing experience and credit cards. He recently partnered with one of the largest digital asset platforms to promote ICO and token trading. Prior to that, he worked as Head of Business Development and Head of Account Management at a digital marketing company registered on Nasdaq. He started his career at American Express.

CHIEF PRODUCT OFFICER - JONATHAN, YT LEE

Jonathan, YT Lee is a senior professional with 15 years experience in cross-border payments, FX and digital wallet designs. Specializing in developing merchants in China and the United States, Lee mastered one of the largest brand loyalty cards in Asia. He works at American Express and Mastercard, as well as in large digital payment companies. He graduated from the London School of Economics.

Jonathan, YT Lee is a senior professional with 15 years experience in cross-border payments, FX and digital wallet designs. Specializing in developing merchants in China and the United States, Lee mastered one of the largest brand loyalty cards in Asia. He works at American Express and Mastercard, as well as in large digital payment companies. He graduated from the London School of Economics.

CHIEF TECHNOLOGY OFFICER - WILLIAM, CY CHAN

William, CY Chan built his career for almost 20 years in developing innovative solutions in the trading and payment arena. He began his career as a Java card developer to build and design secure mobile solutions for banking and stock trading applications. He has been active in enabling trade in new technology, which utilizes his payment expertise in the following areas:

William, CY Chan built his career for almost 20 years in developing innovative solutions in the trading and payment arena. He began his career as a Java card developer to build and design secure mobile solutions for banking and stock trading applications. He has been active in enabling trade in new technology, which utilizes his payment expertise in the following areas:

- Security and cryptography

- Java and QR Programming

- Cellular Payment Solution

- Tokenisation, digitalization, provision, identity and authentication

- Push payments, People-to-Person, remittances, disbursements, CY has 2 US and PhD patents.

CHIEF DIGITAL OFFICER - BRIAN, CW TSE

Brian, CW Tse has 10 years of digital marketing experience and e-business banking industry. His strong knowledge of digital strategy stems from a decade of specialization in O2O digitalization and digital advertising in Asia. He previously worked as a Lead of Account Management at a digital marketing company registered on Nasdaq and began his career at Citibank.

Brian, CW Tse has 10 years of digital marketing experience and e-business banking industry. His strong knowledge of digital strategy stems from a decade of specialization in O2O digitalization and digital advertising in Asia. He previously worked as a Lead of Account Management at a digital marketing company registered on Nasdaq and began his career at Citibank.

CHIEF FINANCIAL OFFICER - KS CHUNG

KS Chung has more than 20 years of extensive experience in financial strategy and planning, corporate finance and investment, and corporate governance. He previously held managerial positions and played leadership roles at Fortune 500 Companies, including PPG Industries and TravelPort of Blackstone Group. Recently, he is VP-Finance of Blue Ocean Pay and CFO of Edko Films Limited and Broadway Company Group. He received a BSc (Hons) from the University of Ulster, and an Executive MBA from the Chinese University of HK. He is a fellow member of HKICPA and a member of the AICPA.

KS Chung has more than 20 years of extensive experience in financial strategy and planning, corporate finance and investment, and corporate governance. He previously held managerial positions and played leadership roles at Fortune 500 Companies, including PPG Industries and TravelPort of Blackstone Group. Recently, he is VP-Finance of Blue Ocean Pay and CFO of Edko Films Limited and Broadway Company Group. He received a BSc (Hons) from the University of Ulster, and an Executive MBA from the Chinese University of HK. He is a fellow member of HKICPA and a member of the AICPA.

ADVISORY BOARD

Yuen Wong

Yuen Wong is the Galaxy eSolutions Co-Founder & CEO. His company succeeded in completing the first ICO in HK in the sharing and circular economy. He has a strong awareness of e-commerce and entrepreneurial initiatives, which gives him the ability to make businesses operate successfully in the global consumer market. His expertise lies in the fields of entrepreneurship, business development and the field of e-commerce specialists.

Yuen Wong is the Galaxy eSolutions Co-Founder & CEO. His company succeeded in completing the first ICO in HK in the sharing and circular economy. He has a strong awareness of e-commerce and entrepreneurial initiatives, which gives him the ability to make businesses operate successfully in the global consumer market. His expertise lies in the fields of entrepreneurship, business development and the field of e-commerce specialists.

Dominic Wu

Dominic Wu is the Managing Director and CRO for Bank of New York Mellon. During his career of more than 20 years, he has held senior executive positions in Risk, Finance, and Operations across Investment banking, Banking transactions, and Trust businesses. In addition, he is the Chair of Think Thinking Asia Financial Risk Management, Chairman of the Asian Chapter at the Institute of Operational Risk and Principal of the TGE Beijing Global Research Institute. He sits on the Hong Kong University of Science and Technology Advisory Board and the Federation of Hong Kong Business Students.

Dominic Wu is the Managing Director and CRO for Bank of New York Mellon. During his career of more than 20 years, he has held senior executive positions in Risk, Finance, and Operations across Investment banking, Banking transactions, and Trust businesses. In addition, he is the Chair of Think Thinking Asia Financial Risk Management, Chairman of the Asian Chapter at the Institute of Operational Risk and Principal of the TGE Beijing Global Research Institute. He sits on the Hong Kong University of Science and Technology Advisory Board and the Federation of Hong Kong Business Students.

Joe Ngoi

Joe Ngoi has founded and invested in various IT companies in the last 20 years, operating in markets ranging from companies to consumer services, including online advertising, event tickets, travel and niche information resources. The company's global website and mobile app itself has recorded more than 2 billion user views, and is also an early user of blockchain and cryptocurrency technology since 2013. Joe previously worked at KPMG Consulting and graduated from Imperial College London with First Class Honors. He currently sits on the board of various start-up companies and growth stages.

Joe Ngoi has founded and invested in various IT companies in the last 20 years, operating in markets ranging from companies to consumer services, including online advertising, event tickets, travel and niche information resources. The company's global website and mobile app itself has recorded more than 2 billion user views, and is also an early user of blockchain and cryptocurrency technology since 2013. Joe previously worked at KPMG Consulting and graduated from Imperial College London with First Class Honors. He currently sits on the board of various start-up companies and growth stages.

Rajesh Sabari

Rajesh Sabari is currently encouraging strategic partnerships and business development for Mastercard Advisors at APAC and has collaborated with various financial services companies, investment managers, private equity companies, media companies, e-commerce retailers, AI & Machine learning companies, and government agencies to transform Mastercard's massive payment network into business insights that can be followed up. Previously, Rajesh acted as a trusted advisor to various communication service providers and media companies on various continents in various leading multinational companies, such as Singtel, Amdocs, and Syniverse. Rajesh is responsible for building three companies from scratch to become a recurring revenue generator based in Japan. Rajesh has an MBA (High Honors, Distinction) from Chicago Booth University and B. Eng (Hons) from the National University of Singapore. He is also the CFA charter holder.

Rajesh Sabari is currently encouraging strategic partnerships and business development for Mastercard Advisors at APAC and has collaborated with various financial services companies, investment managers, private equity companies, media companies, e-commerce retailers, AI & Machine learning companies, and government agencies to transform Mastercard's massive payment network into business insights that can be followed up. Previously, Rajesh acted as a trusted advisor to various communication service providers and media companies on various continents in various leading multinational companies, such as Singtel, Amdocs, and Syniverse. Rajesh is responsible for building three companies from scratch to become a recurring revenue generator based in Japan. Rajesh has an MBA (High Honors, Distinction) from Chicago Booth University and B. Eng (Hons) from the National University of Singapore. He is also the CFA charter holder.

Join now !!!, We are waiting for your participation to join this project.

Author: gafman

Bitcointalk Profile link: https://bitcointalk.org/index.php?action=profile;u=1903236

Bitcointalk Profile link: https://bitcointalk.org/index.php?action=profile;u=1903236

Comments

Post a Comment